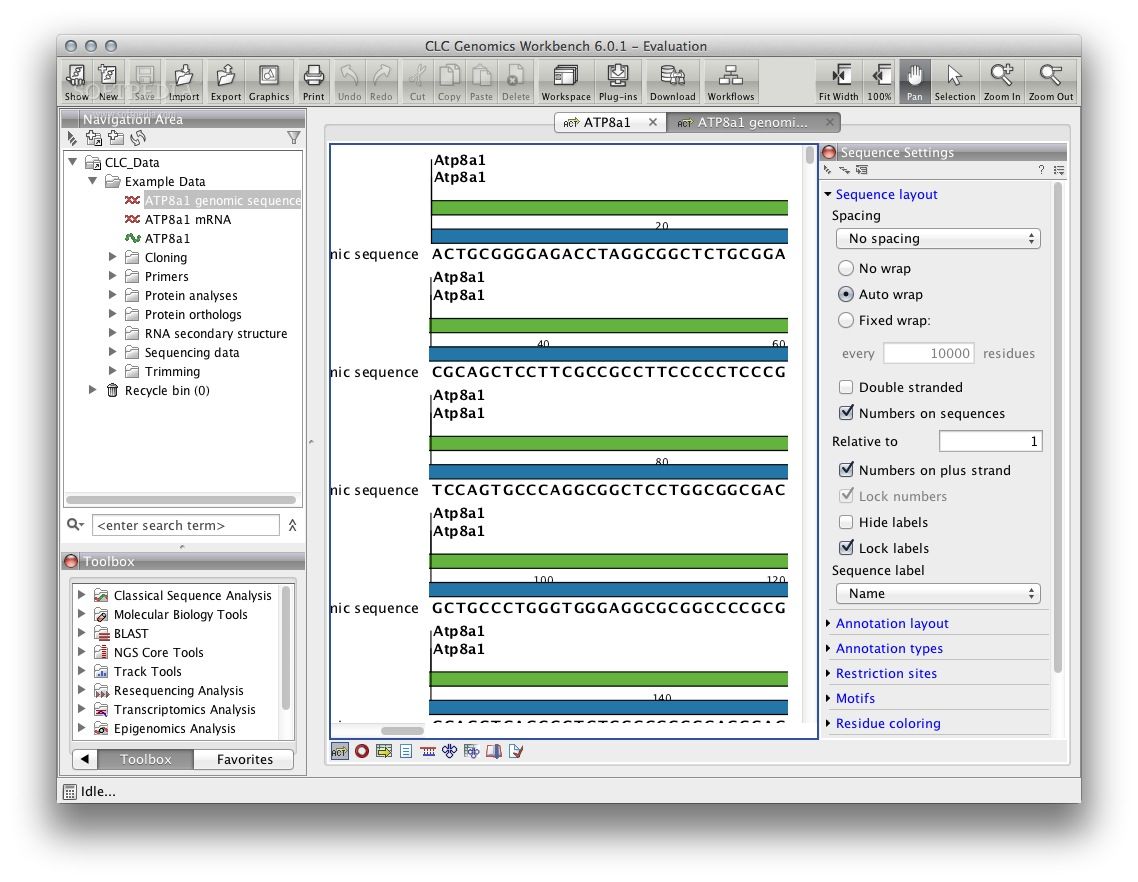

Shares of HOLX have gained 12.5% compared with the industry’s 14.8% growth over the past year. It has an earnings yield of 4.95% compared with the industry’s -5.71%. Hologic currently sports a Zacks Rank #1. ZBH’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 7.38%. Zimmer Biomet shares have rallied 39.8% against the industry’s 21.3% decline over the past year. It has an earnings yield of 5.23% compared with the industry’s -3.14%. Zimmer Biomet presently carries a Zacks Rank #2 (Buy). Haemonetics’ shares have gained 32.6% against the industry’s 21.3% decline in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here. Haemonetics’ earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 12.21%. It has an earnings yield of 4.17% compared with the industry’s -3.14%. Haemonetics, currently sports a Zacks Rank #1 (Strong Buy). Some better-ranked stocks in the broader medical space are Haemonetics HAE, Zimmer Biomet ZBH and Hologic, Inc. This suggests a decrease of 4.7% from the year-ago reported number. The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $2.04 billion. In the past 30 days, the Zacks Consensus Estimate for QIAGEN’s 2023 earnings per share has remained constant at $2.12. This indicated a significant decline of more than 30% CER in China due to COVID headwinds from the first quarter of 2022. In the first quarter of 2023, the Asia-Pacific / Japan region non-COVID sales were largely unchanged compared with the prior-year quarter’s figure. International Sales Discouraging: QIAGEN currently markets products in more than 100 countries. Stiff competition from firms offering pre-analytical solutions and other products used by QIAGEN’s customers continues to persist. QIAGEN’s first-quarter adjusted operating income reflected a significant decline in COVID-19-related sales and higher R&D investments compared with the prior-year period. Mounting Expenses Put Pressure: The company’s year-over-year decline in the top and bottom lines raises apprehension. The company’s bioinformatics business introduced an enhanced QIAGEN CLC Genomics Workbench Premium, incorporating Lightspeed’s ground-breaking technology. In January 2023, QIAGEN launched EZ2 Connect MDx for use in diagnostic laboratories. The first partnership with SOPHiA GENETICS will bring together QIAGEN’s QIAseq reagent technology with SOPHiA DDM digital analytics platform to expand compatibility with data-driven medicine. In addition, the company launched the QIAseq Platform Partnership program in March 2023. QIAGEN recently expanded its QIAseq Targeted DNA product portfolio with the addition of cell-free DNA NGS kits. Solid NGS Platform Prospects: In the last reported quarter, Genomics/NGS portfolio reported solid CER growth in the universal NGS kits for use in any sequencer and in the QIAGEN Digital Insights bioinformatics business. QGEN’s earnings surpassed estimates in all the trailing four quarters, delivering an average surprise of 13.1%. QIAGEN has an earnings yield of 4.70% compared with the industry’s -31.47%. The renowned global provider of sample and assay technologies has a market capitalization of $10.27 billion. The S&P 500 composite has witnessed a 15.8% rise in the said time frame. In the past year, this Zacks Rank #3 (Hold) stock has declined 2.5% compared with a 12% decline of the industry. Escalating expenses are an added concern. Meanwhile, COVID’s headwinds in China impacted the company’s international revenues. QIAGEN is also progressing well with its testing menu expansion strategy. The company’s next-generation sequencing (NGS) portfolio has been witnessing double-digit revenue growth over the past few quarters. QGEN is well-poised for growth in the coming quarters, backed by the broad-based organic sales growth from its non-COVID product groups.

0 kommentar(er)

0 kommentar(er)